OK Ben, let me ask you a simple question.

What would happen if the US Treasury issued $2 trillion or $5 trillion in bonds today to bail out the banks and pay for government overspending, and the Fed bought them all?

Think bigger Ben. Think bigger.

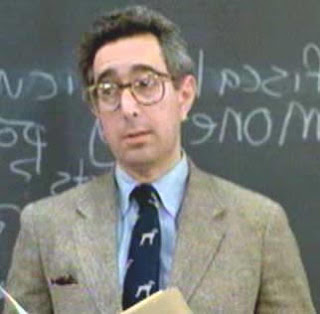

Here's Ben, defending himself, while piling on Schiff:

I assume that Peter Schiff is a fine and capable man. But he is not Superman. He is a man. No more. Recently I heard him make a prediction on a California radio station of simultaneous ruinous inflation and a complete collapse of the economy. At least this is what I understood him to be saying.

This scenario has no precedent in history that I am aware of. Maybe we have skipped the rails of history, but a huge increase in demand -- fueling inflation -- coincident with a huge drop in economic activity (which is what I understand Mr. Schiff to be predicting -- maybe I am wrong) would make no arithmetic sense. Maybe it will happen anyhow. But it is very far removed from typical cause and effect.

23 comments:

No precedent? How about Argentina, Zimbabwe etc

Ben should stand in front of that sports car in "Bueller." When I'm in the driver's seat.

You're incorrectly presuming that inflation is caused by rising demand.

Inflation is caused by monetary expansion.

What an idiot.

Everywhere that has had hyperinflation has been in economic boom times. Hyperinflation is great for the economy!

This fool should stop pretending to be an economist and should go back to being a bit player in sh*tty teen movies. Maybe he can go work with Hannah Montana.

Someone oughtta tell that clown about the Weimar Republic

Why is the blog promoting this useless hack?

Pleas, stay on point. Enough distractions already...

What next, Brittany?

Doesn't Mish say that inflation/ deflation are monetary phenomena?

If that is the case then Ben is pretty far off base.

yup, he might be wrong. there is precendense on his being wrong...remember Merrill Lynch?

Weren't Ben's 15 minutes up about 15 years ago?

Don Payne

1923 Weimar Germany Hyperinflation leading to end of Weimar Republic and begining of Natzi Germany. And we all know who got the blame for the ecomony when the Chosen People still had silver and gold and the non jews had wothless paper. Special Treatment (Natzi term for gas chambers) for the chosen people so use to being treated special. Ben Stein should know better. But I am sure Ben Stein like most of my Jewish friends who are so much smarter than my non Jewish friends has plenty of silver and gold to survive any hyperfinflation and economic collapse. I fear, however, that many Jews never leaned from Germany and still do not own guns, especially Communist California, where Stein lives in Malibu. Guns are the only thing to protect your gold when hyperinflation is stealing your money. As a Boomer, Stein is eternally opptimistic that things will get better, not have any learned historical presendent that they are correcting for the worse, due to the demographic change of Boomers becoming busters as they downsize from consumers to consumed.

Anonymous said...

Doesn't Mish say that inflation/ deflation are monetary phenomena?

If that is the case then Ben is pretty far off base.

Mish also says that inflation may very well take off down the road, but first the leverage and bad debt has to be wrung out of the system.

He has never said that there will never be inflation, only that the immediate concern is deflation and to trade accordingly so you don't wipe out your customers.

JaneZ

Ben Stein's an idiot who's been wrong in just about every prediction he's made about the economy. Next to him uber-idiot Larry Kudlow look like Albert Einstein.

Stein is misapplying the adage that inflation is the result of too much money chasing too few goods. If this were the case then it would in fact be contradictory that an increase in demand could coincide with a drop in economic activity, but that is not the situation. The money being created is not being fed into the economy but rather it is simply being dispensed to "make good" on bad bets that have already happened. None of this "new" money will ever see the light of day in the general economy. It will only be used for corporate balance sheet transactions and thus won't spur economic activity but will nonetheless increase money supply. The only effect to the general economy will be to (temporarily) prop up asset prices, which in turn will serve to further suppress economic activity. And as the decreased economic activity further weakens the same corporations being bailed out it will then be necessary to continue printing money to prop up the same entities, resulting in an non-stop hyperinflationary cycle.

"Stein is misapplying the adage that inflation is the result of too much money chasing too few goods."

"Too much money" has to do with monetary expansion--too much money in the economy, as when printing presses run 24/7.

It's not quite the same as consumer demand. Comsumer demand can make the cost of particular things go up. If consumer incomes are rising, then inflation is not a worry--rising incomes + rising costs is a wash.

Too much money in the economy makes everything go up, and even if incomes are flat or going down.

Well, Ben Stein also correlated Hurricane Katrina to an amoral culture, down by the Bayou, and lack of religious observance in modern society but then failed to connect the dots as to why NYC, Amsterdam, and Rio, also with amoral, non-religious activities (i.e. sex, rock 'n roll, and drug use) didn't suffer some karmic cosmic retribution from Mother Nature. He's a joke, possibly the most useless talking head out there, hiding behind a Yale diploma of credibility.

The only way to spur a true runaway inflation, for a reserve currency like the USD or GBP, is to quite literally give money to the masses w/ no strings attached.

As long as the money is doled out, as incremental lines of credit, that money spent will need to be serviced using minimum monthly payments and what does that is in effect, place a boundary on runaway inflation.

On the business side of things, if a bank leaves that extra line of credit on their books, to shore up corporate lending then it simply doesn't do anything... pushing on the string. The companies don't borrow more than they have to because consumers aren't buying enough and at the same time, the debt needs to be serviced monthly so that keeps the use of the revolving door of credit at a minimal.

Stein is a boob extraordinaire. He says boobish things, his intonation is boobish, and of course his looks are well - ya get the drift. Witness his comments on the "Peter Schiff was Right" video on YouTube, wherein he blathers about the financials being a screaming bargain, particularly M-L, which he characterized as being "extraordinarily well managed". Hahahaha - stop it Ben yer killin me.

Stein is from the If It Feels Good Do It school of economics, now required training for all economists in the US.

There is plenty of room for both Schiff and Ben Stein to be wrong on this one. Both have already proven to be very wrong in their predictions to date...

Timing is everything...

Keith,

So far the Federal Gov't has MASSIVELY expanded its balance sheet to an unprecedented extent. Interest rates are at their lowest level ever and yet demand AND prices are still falling off a cliff. So far, you and Schiff are the ones who are wrong in your constant yammering about inflation...How about that dollar? It's still screaming higher and outperforming all assets including your beloved GOLD...

No inflation can happen without a comensurate rise in wages.

Any inflation would be limited and unsustainable.

Yea it happened in Germany but Germany had wage agreements with the union.

Not here in America.

Inflation is as remote as the moon.

Think ex Soviet Union in the 90's

GDP down 60-90%, inflation at 5% per day.

75% of transactions are berter, the rest are priced in US dollars adn german marks.

Fun times,

Never want to live through that again.

Post a Comment